This article is proudly sponsored by Texas Student Media!

Why Establishment Labs (NASDAQ: ESTA) Is a Poised Winner in the Global Rotation Toward Emerging Markets

Ticker: Establishment Labs Holdings Inc. (NASDAQ: ESTA)

Rating: BUY

Thesis Date: July 2025

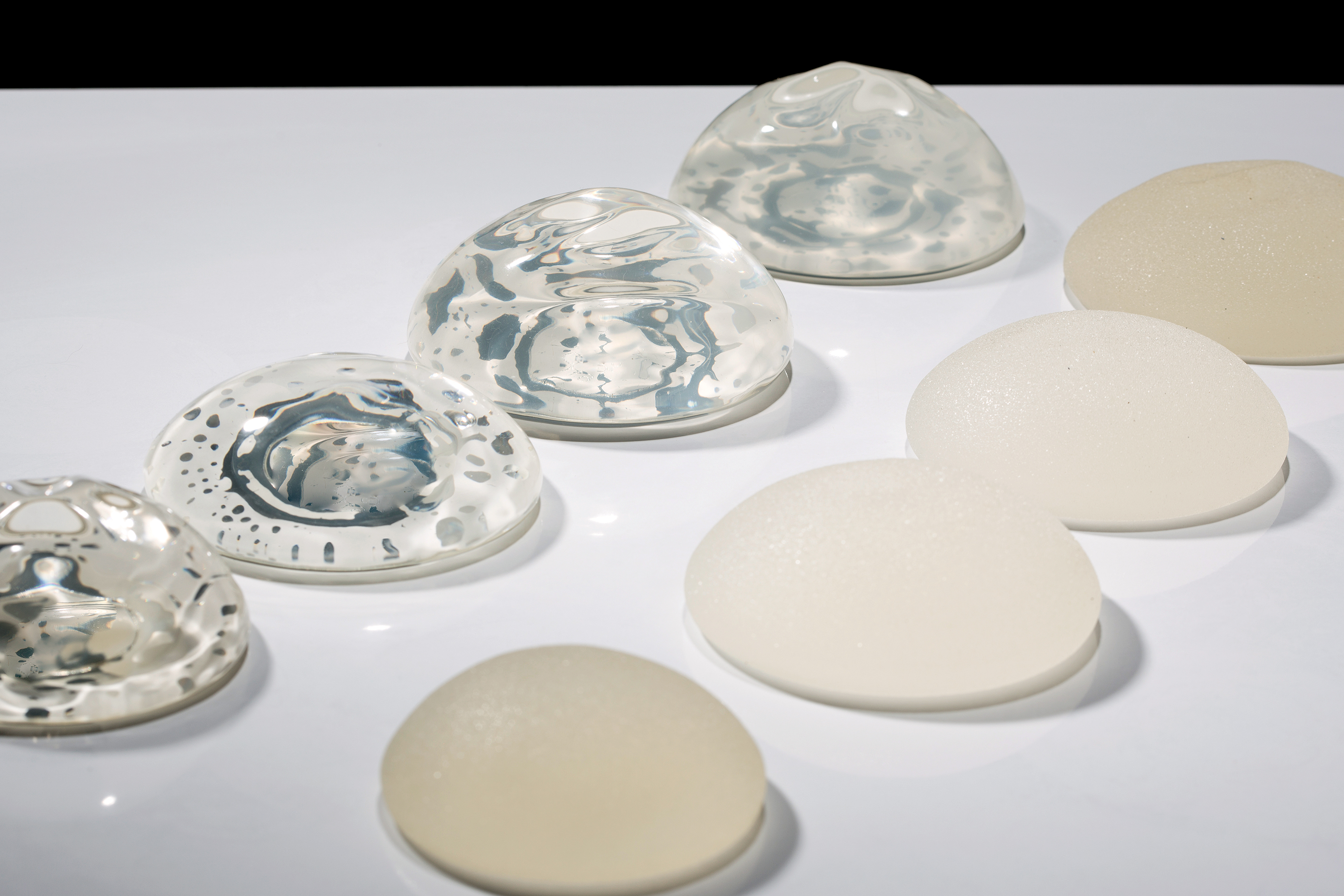

Establishment Labs might be known as a medtech company specializing in breast implants—but under the surface, it’s a textbook macroeconomic play. In fact, for investors with an eye on shifting global capital flows, declining interest rates, and emerging market tailwinds, ESTA is one of the smartest ways to capture the next rotation wave.

Here’s why this Costa Rica-based innovator is more than meets the eye:

Thesis: EM Capital Rotation + Consumer Upside = Asymmetric Alpha

1. Emerging Market Rotation: From U.S. Volatility to Costa Rican Resilience

With growing concerns over U.S. credit quality—highlighted by Moody’s downgrade and no major agency currently rating U.S. debt above AA—investors are increasingly seeking refuge in stable, underappreciated emerging markets. Costa Rica, Latin America’s oldest and most stable democracy, is a prime beneficiary.

Capital is flowing out of G7 uncertainty and into high-trust EM economies.

Establishment Labs, headquartered in Costa Rica with a strong international distribution footprint, is perfectly positioned to capture this inflow—both in terms of investor capital and real economic growth.

2. Interest Rates in Costa Rica Have Plummeted—Consumer Spending Is Rising

Interest rates in Costa Rica have dropped sharply from ~10% in 2023 to around 4% in mid-2025 (as of May 29, 2025). This is not just a monetary curiosity—it directly improves household affordability, especially for discretionary spending categories like aesthetic procedures.

Most breast augmentation procedures are financed, and Establishment Labs’ Motiva implants fit squarely into that demand pool. With lower rates increasing access to credit, volume growth is likely to accelerate, particularly among price-inelastic consumers who already show resilience in uncertain economic periods.

3. Breakout U.S. Expansion and Margin Improvement

Establishment Labs isn’t just an emerging market story—it’s now a full-blown international growth story.

-

Q1 2025 revenue: $41.4 million (with $6.2 million from U.S. sales)

-

Full-year 2025 guidance: $205M–$210M, reflecting 23%–26% YoY growth

-

Gross margin: 67.2%, boosted by premium geographic mix and higher ASPs

-

U.S. launch: Momentum building fast—Motiva is on pace to exceed the $35M U.S. revenue guidance

Translation: You’re getting a fast-growing U.S. market entry and the EM tailwind in one stock.

Bottom Line: ESTA Is an Overlooked Macroeconomic Winner

Establishment Labs (ESTA) isn’t just a medtech company—it’s a high-conviction macroeconomic trifecta:

-

Emerging market capital rotation into trusted regions like Costa Rica

-

Improving consumer affordability thanks to declining interest rates in Costa Rica (and soon the U.S.)

-

Strong financials and U.S. growth runway, with revenue and margin expansion already in motion

As the Fed moves toward gradual rate cuts (expected in late 2025 or early 2026), U.S. consumers will find it even easier to finance elective procedures—boosting ESTA’s top line even further. And with many aesthetic patients being price inelastic, the downside is relatively protected even in a shaky macro.

For investors seeking exposure to:

-

Emerging market stability

-

Rate-sensitive discretionary growth

-

A medtech disruptor with expanding global reach

Establishment Labs (ESTA) checks all the boxes.

DISCLAIMER: This analysis of the aforementioned stock security is in no way to be construed, understood, or seen as formal, professional, or any other form of investment advice. We are simply expressing our opinions regarding a publicly traded entity.

© 2025 MacroHint.com. All rights reserved.