This article is sponsored by Light of True Liberty!

About Blackstone

It has become a consistent routine of mine to take the city bus from near my apartment fifteen minutes westbound to the heart of my university’s campus, throw on my headphones and gather my thoughts while also drifting away to some music (and boy do I have a variety of artists on my playlist, some of my personal favorites including the likes of Bas, Mel and Tim, A Tribe Called Quest, Creative Source, Donny Hathaway and only a few others can make the shortlist when it comes to my evening strolls, but enough on that), breathing in some fresh air and gain some perspective about what I’m really doing with my life and maybe every so often I’ll have some revelations.

Sometimes I’ll head home more confused than when I initially arrived and sometimes I’ll feel incredibly relieved and steadfast.

It frequently varies.

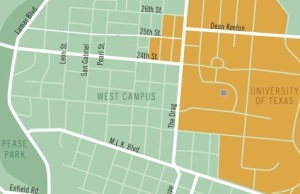

Oh yeah, and I will also be surrounded by so many student housing projects and new near campus real estate developments owned and operated by the company of discussion today that my head will start to spin, many of which happen to evidently be owned by Blackstone, which took full ownership of the original developer and owner of the aforementioned properties, American Campus Communities (ACC) (for $13 billion), that is, prior to being fully bought out by Blackstone, one of the world’s largest asset managers (headquartered in where else but New York City, New York), with reportedly $1 trillion in terms of assets under management (AUM), with its hands in a few different cookie jars, each cookie jar generating substantial amounts of revenues and profits for the alternative asset management firm, the main categories and streams including private equity, real estate, hedge fund operations, credit and a plethora of other smaller, perhaps lesser known yet still highly profitable operations under Blackstone’s belt.

As a brief overview of each of these strategies, private equity is basically a firm (Blackstone in this case) buying out an entire company (usually a private company), then stripping it of a multitude of costs, making it more operationally efficient and selling it for more than it originally paid for it.

Buy a company at one price, spend a few years working on it and making it better (ideally, anyway), then selling it for more in the following handful of years, sometimes two fistfuls of years, depending on the buyout target in question and other factors.

Blackstone’s real estate operations basically include buying properties of all sorts, shapes, sizes and uses and charging inhabitants and/or users of the space(s) rent, acting as a meaningful source of cash flow for Blackstone.

Take American Campus Communities for example.

.svg/330px-The_Blackstone_Group_logo_(2).svg.png)

Adjacent to my university’s campus alone, Blackstone (through their aforementioned acquisition of American Campus Communities) receives a healthy amount of monthly student rent checks from my peer inhabitants of, say, The Castilian, Crest at Pearl, The Callaway House, 26 West, The Block, or all of the other properties and complexes managed by Blackstone, of course, not only in Austin, Texas, but spread out across the rest of the United States and the world as well.

And this is just one of their many real estate operations and related revenue streams, mind you.

Its hedge fund operations essentially include trading desks that try to make some sort of return on their trades and investments, whether it is a desk fully focused on long/short equity investing or something as niche and complex as options and futures arbitrage, additionally charging management and performance fees for its asset management services, leading up to the last major revenue source that we will be tapping into today, its credit division.

Namely, credit in the context of high finance is broadly considered as a general form of debt investing, better known sometimes as distressed debt investing, which is essentially buying into some piece of a flailing company’s capital structure (with each level having a different payment schedule priority and set of obligations, with those at the top of the capital structure typically having priority to receive the first money or returns prior to anyone else below them on the capital structure, and so on and so forth), and if the company is sufficiently turned around and begins moving back in the right direction, investors within the capital structure tend to make a handsome return on their investments, to say the least.

Of course, a company such as Blackstone can easily afford to hang out at around the top of essentially any company’s capital structure, mitigating many repayment risks other smaller alternative asset management players might be subjected to, or those that are lower in priority within the capital structure.

Credit investing does go deeper but in the interest of everyone’s time, we aren’t going to get too far down this rabbit hole.

Instead, we are going to wrap up our necessarily lengthy introduction of Blackstone and introduce some of the trillion-dollar asset manager’s core financials that can be found within the company’s financials and some other metrics that will lead us to devise an eventual opinion on its stock (NYSE: BX) and the prospects thereof.

Blackstone’s stock financials

With a market capitalization of $150.89 billion, an associated stock price of $123.49, Blackstone has a present price-to-earnings (P/E) ratio of 67.44 along with an annually dished out dividend of $3.32 to its shareholder base.

In considering this initial data and converting it into more digestible, sensible information, it can be gathered through Blackstone’s stock price (NYSE: BX) that it is indeed a very large company (specifically referencing its market capitalization), and perhaps more importantly, it can be seen that this company’s stock price has gotten all too ahead of itself, touting a price-to-earnings ratio that is many points above the generally held average fair value benchmark of 20, which in the case of Blackstone makes sense, with the company’s share price appreciating just about 40% over this last trailing twelve months span of time.

Nevertheless, if some meaningful, defined growth is pushing Blackstone forward, paying a premium might just be worth it, but we’ll see, as this is a rather large premium to pay under any circumstances.

With that, Blackstone’s executive team is tasked with taking care of properly managing and deploying approximately $42.5 billion in terms of total assets as well as almost $34.9 billion in terms of total liabilities, which, for such a large asset management company, is far from concerning to us, especially given its proven long-term track record of extracting more than solid returns from the investments it makes and the companies it acquires, and its sheer top-dog status within the finance industry as a whole.

In other words, a lot would have to go wrong before this company went out of business, and frankly it would be so catastrophic we don’t even want to begin imagining what sort of a state of ruin the world would be in if Blackstone closed up shop for good, and with a balance sheet such as this one, it will not close up shop anytime soon.

That’s a lot of power, for better or for worse.

Regarding the company’s recent annualized revenue figures, since 2018 in particular, Blackstone’s revenues have fluctuated every so often in this relatively short period of time (measuring between and during 2018 and 2022, by the way), which tracks with the fact that much of this company’s revenues are primarily rooted in deals and, with that, heavily reliant upon deal flow, and when deal flow dries up, this will undoubtedly have an impact, more than likely a negative one, on Blackstone’s and other private equity firms’ revenues.

Additionally, simply engaging in the process of buying and selling companies throughout any given month or year is surely going to cause some shifts in revenue, however, for the most part, Blackstone’s revenues have been moving in the right direction over this span of time (generally ranging between $6 billion and $8 billion) and it also pays (literally) to have a good deal of other businesses and more stable revenue drivers such as all of the real estate it owns and extracts cash flows from as well as through other core businesses such as collecting fees through its hedge fund division(s), among others.

As it relates to the company’s cash flow statement, Blackstone has been fairly consistent and positive on this front as well, clocking in recent historical figures that make complete and utter sense given the aforementioned fact of the matter that as deal flow and accretive market opportunities come and go, so will its revenues, and with that, its cash flows as well.

Nevertheless, the company’s net income and corresponding total cash from operations figures have remained positive each and every year between and during 2018 and 2022, which is to be largely expected of one of the world’s largest multi-strategy asset managers, but nevertheless a positive item to check off of the list.

Blackstone’s stock fundamentals

Moving right along to the company’s comparable profitability metrics (as they are shown on TD Ameritrade’s platform), Blackstone’s certainly doesn’t disappoint, especially given that it butts heads against some other more than formidable foes, such as private equity giant KKR, fellow private equity behemoth The Carlyle Group, Apollo Global Management and a handful of other multi-billion-dollar asset managers.

Specifically, the company’s listed trailing twelve month (TTM) net profit margin is listed as 36.47% to the industry’s respective average (including the aforementioned competitors) strong but not nearly as competitive 21.06%, clearly indicating that Blackstone is superior on the comparable profitability spectrum, alluding to the fact that it has developed quite a solid track record for itself through the operations it has put into place, whether through its real estate operations, its private equity lineup, or through the gamut of other investment vehicles it has developed and marketed throughout the years, and decades.

Speaking more to the company’s returns, Blackstone’s core TTM returns (as also found on TD Ameritrade’s platform) as they particularly relate to its returns on assets and investment(s), the investment house in question has once again made a good name for itself, with, for example, the company’s TTM return on assets being pegged at 7.52% to the industry’s respective average of -5.95%, along with the company’s TTM return on investment sitting pretty at 17.06% to the industry’s less exciting and compelling average of 8.15%, both figures indicating that Blackstone has done a historically better job at planting down and executing the right investments, and given the storied history and prowess of the asset manager, this likely won’t change anytime soon, especially given that Blackstone is a top target recruiting firm on Wall Street, attracting some of the most top-notch university talent across the world.

Should you buy Blackstone stock?

This valuation stuff is really getting under my nerves, but we need to prize objectivity at all costs.

And Blackstone won’t be an exception.

While this absolutely massive company has a lot to offer, it isn’t currently enough (at least in our eyes) to warrant paying more than a couple times over (on the price-to-earnings spectrum), as the catch-22 of being such a large, successful company is that the larger you become, the inherently less nimble you become and the more tapered off one’s growth typically becomes.

Sure, Blackstone has experienced some growth spurts on the revenue and cash flow fronts in recent history, however, they certainly do not lead us to readily nor willfully pay this much of a premium at the moment, not to also mention the fact that, in certain respects, this company operates similarly to a bank, and we all know that banks, small or large, are certainly not immune to recessionary, inflationary and other sorts of prevailing economic pressures and threats.

Evidently, big does not necessarily always mean recession resistant, nor best for that matter.

At any rate, Blackstone touts a good balance sheet, all things considered, its revenues and cash flows are just about on par with what we had initially expected, and its TTM net profit margin and other previously mentioned core return metrics level the competition’s averages by comforting margins.

But the valuation is the sticking point and we are sticking to it.

Given the stock’s (NYSE: BX) rather sizable run-up in the last year and some change, it seems as though it has become a bit too ahead of itself, but incorporating its positives, we think it would be best if we offered this company’s stock a “hold” rating.

DISCLAIMER: This analysis of the aforementioned stock security is in no way to be construed, understood, or seen as formal, professional, or any other form of investment advice. We are simply expressing our opinions regarding a publicly traded entity.

© 2024 MacroHint.com. All rights reserved.