This article is proudly sponsored by the Business Ethics Team at the University of Texas at Austin!

About Datadog

Every now and again I’ll find myself needing to blow off some steam or just tune out for a few minutes and I’ll make my way over to one of my university’s outdoor basketball courts towards the southeast end of campus.

I’ll check out a basketball from the help desk, walk over to the nearby outdoor court, stretch like the old man that I am slowly but surely becoming and proceed to put up a few jumpshots, the first usually being my absolute ugliest and worst.

I’ll spare you the details but let’s just say no collegiate basketball program has me on their radar!

Nevertheless, this is one of the main elements through which I get away from the daily stresses of school and my other on-campus obligations, well, that and peering over 13Fs, which is basically a regulatory filing that sizable investment firms have to periodically publish, showing up to a certain point which securities (i.e., stocks) were recently in their portfolios, how much of a percentage weight each maintained relative to the entire portfolio and how much in terms of assets under management (AUM) the firm had (or maybe still has, it is hard to say) under its belt, among other general metrics.

While it certainly by no means should be used or seen as a firm indicator of where you should invest your money, it is nevertheless quite fun for nerds such as myself to look at and see where some of the largest, most successful investors and their funds are putting their capital to work.

At any rate, during this particular basketball de-stress session, I stumbled onto the fact that the Formula One race was happening in Austin, Texas and with that, saw on a premier flight tracking platform that one of the world’s most accomplished hedge fund managers, Stanley Druckenmiller, happened to be in town (well, at least one of his personal aircraft) and that was just enough to get my wheels turning regarding what his firm, the Duquesne Family Office, had most recently reported in their respective 13F.

For those who have already put two and two together, at the time, Datadog (NASDAQ: DDOG) happened to be one of the firm’s larger holdings and during that same time, I pretty much knew little to nothing about Datadog, what it did, how it made money, whether or not it could be considered a recession proof stock, among other burning questions.

Well, good thing I’m writing an article on the company today, I suppose.

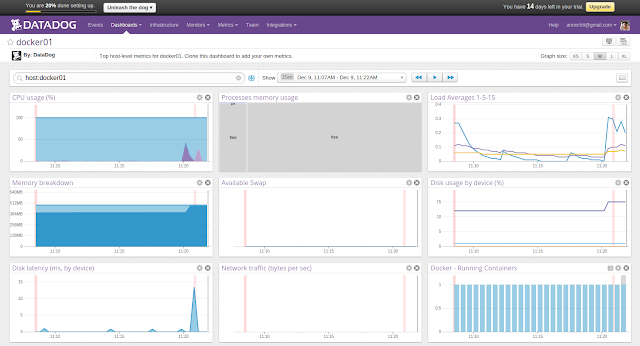

Datadog is broadly categorized as a software as a service (SaaS) company that specializes in data observability, greatly integrating and seamlessly assisting (no, this article isn’t sponsored by Datadog) developers and other members of an organization’s back-end to essentially identify all that is happening, the good, the bad and the ugly, as it relates to the data gathered in the back-end, allowing teams of developers to identify trends, interact with another and ultimately take the steps needed to fix or alter something in the back-end when necessary.

No wonder the company is named Datadog, as it can quite literally be thought of as a little dog that continuously fetches you data.

While in recent history the broader SaaS industry has proven itself to be a bit more cyclical than perhaps anticipated, Datadog’s products are quite sticky in the sense that once a company or other organization begins integrating their platform(s) with Datadog’s, it is quite the challenge to migrate off of its platform, which we deem to be an indefinite tailwind for a company such as this one, not to mention that it supports and serves some of the most prominent companies in the world that, regardless of the economic conditions that come its way, can and will continue paying for access to the company’s platform, including the likes of Siemens, Shell, The Washington Post, Deloitte, Comcast, Whole Foods, Maersk, Harvard Medical School and Twilio, among many other enterprise customers.

Now that some of the ground work regarding New York City, New York-headquartered Datadog has been laid, it’s time to learn more about this founder-led company from a financial perspective, as we delve into learning more about this company, its core financials and other relevant metrics and ratios inquisitive investors should consider prior to even considering trading into any security.

Datadog’s stock financials

With a prevailing market capitalization of $25.84 billion, an associated share price of $79.51 as well as no readily available price-to-earnings (P/E) ratio listed nor an annually distributed dividend in sight, we really aren’t all that surprised given that SaaS companies, especially as more and more younger firms emerge into their full forms, as it is commonplace at this point for younger technology firms to forgo issuing a dividend in order to continue funding growth, and with respect to the unlisted price-to-earnings ratio, Datadog might not be net profitable, at least on a trailing twelve month (TTM) basis quite yet, thus it technically has no real earnings to display.

Given the nature of the high-growth SaaS market, these initial figures don’t gravely concern us.

In doing some more digging into Datadog, the company’s executives are in charge of tending to and managing just north of $3 billion in terms of total assets as well as around $1.6 billion in terms of total liabilities, which, for a more than likely rapidly expanding SaaS platform is a balance sheet that is indeed in great shape, as its total assets outweigh its total liabilities by a comforting margin (by nearly double) despite what we assume to be some fairly large, consistent revenue growth.

Speaking of revenue growth, when we tell Datadog jump, it certainly is quick to respond “how high?”

More specifically, since 2018, Datadog has steadily grown its total, year-over-year (YOY) revenues, starting at a base of $198 million, taking the next step up to $363 million, $603 million, to just north of $1 billion in 2021, reaching a new high as of its latest displayed figure (on TD Ameritrade’s platform) of nearly $1.7 billion (2022), which, we don’t have really tell you, is quintessential SaaS platform revenue growth.

This more than strong growth implies that this company isn’t haven’t all that much trouble in retaining its current clients nor is it struggling to acquire new ones, however, what we really want figure out is how much cash (if any) is Datadog burning through in order to just attain these revenue figures, as it can get pretty ugly with younger SaaS companies with respect to cash burn.

According to the company’s cash flow statement, Datadog is a different breed (canine humor) in that while its net income (also referencing since 2018) has technically found itself in the red in recent years, it is not even nearly close as to how bad we thought it might be, as this company’s largest negative net income figure came from 2022, as it reported -$50 million in terms of net income (which should be tended to responsibly and maintained over time but for the time being, this hardly puts a dent in this company’s balance sheet), however, interestingly enough, during this same year the company’s total cash from operations were measured as being $418 million, heavily insinuating that this enterprise has little to no problem with generating positive cash flow, which solidifies its breed status, as it can also be noted that since 2018 its total cash from operations have risen year-over-year, starting at $11 million (2018) and climbing all the way up to $418 million (2022), which is no small feat, again, for a company operating in the SaaS space that was founded only a mere thirteen years ago, in 2010.

Datadog’s stock fundamentals

Speaking of this company’s ability to turn a profit, the company’s trailing twelve month (TTM) net profit margin (according to TD Ameritrade’s platform) stands at a comparably lackluster -4.38% to the industry’s respective average of 10.56%, however, we think as the company continues building out its platform and nabbing more enterprise customers, it will get closer and closer to attaining a positive, similar and competitive TTM net profit margin, but it should still be understood that Datadog goes up against some fairly stiff competition, including the likes of Dynatrace, New Relic, IBM and Amazon Web Services (AWS), among others.

As long as Datadog continues chipping away and sharpening and further scaling out its platform, we think it certainly has a lot of room for growth in terms of getting its TTM net profit margin where it needs to be with respect to the opposition.

As it relates to the company’s listed TTM returns on assets and investment(s), Datadog’s metrics in these arenas are once again in similar, not exactly competitive states at the moment, however, this company practically lives or dies from continuously investing in its platform and related capabilities, therefore, it isn’t all too shocking that the company’s TTM returns on both assets and investments are slightly in the red, with, for instance, the company’s TTM return on investment sitting below at -3.63% to the industry’s respective average of 16.21%.

It is our opinion that it will take some time for Datadog to fill this gap, however, if this is a mere byproduct of investing and reinvesting heavily into its back-end and other products, then so be it, as this is exactly how we think younger SaaS companies should be behaving in their earlier eras.

Should you buy Datadog’s stock?

Datadog is in a rather unique position in that it is an established player in the observability and cloud monitoring sector(s) yet it is still growing like hotcakes.

It is rather difficult to peg this company’s actual valuation given that it doesn’t presently offer a price-to-earnings ratio but more importantly, it is somewhat challenging to incorporate and accurately measure this company’s future earnings potential to a tee, as we think it certainly has a long, long way to go, especially through integrating artificial intelligence (AI) into its product(s) and platform(s).

This being said, from a more value-oriented perspective, we think this company’s stock (NASDAQ: DDOG), among other SaaS operators has some trimming down to do before its valuation gets built back up, as the recent AI hype has driven technology stocks, broadly, up the wall.

Thus, in the interest of not chasing a company’s stock and buying at a more favorable price level in order to mitigate risk, we deem Datadog’s stock worthy of a “hold” rating.

DISCLAIMER: This analysis of the aforementioned stock security is in no way to be construed, understood, or seen as formal, professional, or any other form of investment advice. We are simply expressing our opinions regarding a publicly traded entity.