This article is sponsored by Light of True Liberty!

About Broadcom

I hardly blinked and 45 days later 13F season is back in session.

Some people like taking long walks on the beach and some people enjoy going out to a nice restaurant, and don’t get me wrong, I enjoy these actions too, however, I really enjoy sitting at my desk, listening to some tunes and peering through some of the largest hedge funds and their most recent trades, and while I’ve performed a sort of analysis and quasi-critique on a local hedge fund manager’s holdings back in December, I’m back at it again with one of the most storied, successful hedge fund managers of all time out on the east coast, a protege of the prolific George Soros, Mr. Stanley Druckenmiller, owner and operator of his personal family fund, Duquesne Family Office LLC that he established, well after closing his full fledged hedge fund by the name of Duquesne Capital, where he was previously managing money on behalf of clients and not just himself.

In checking out some of his adding to or establishing new holdings as of the last reporting cycle before his firm’s holdings are updated, one of the things that caught my eye was his somewhat sizable portfolio position in semiconductor giant, Palo Alto, California-headquartered, Broadcom, at the time of this article’s draft (2/9/2024, just prior to holdings being updated) holding a 1.55% stake in the fund overall.

Oh, and according to the filing page Druckenmiller’s position in Broadcom is up north of 50%, so he has clearly done well and hit the nail on the head with this one, which is somewhat, oddly enough, challenging to not do in this sort of AI-crazed environment, as Broadcom is undoubtedly a technology staple that is integrating itself and its operations deeper and deeper into machine learning and artificial intelligence as well as generative AI.

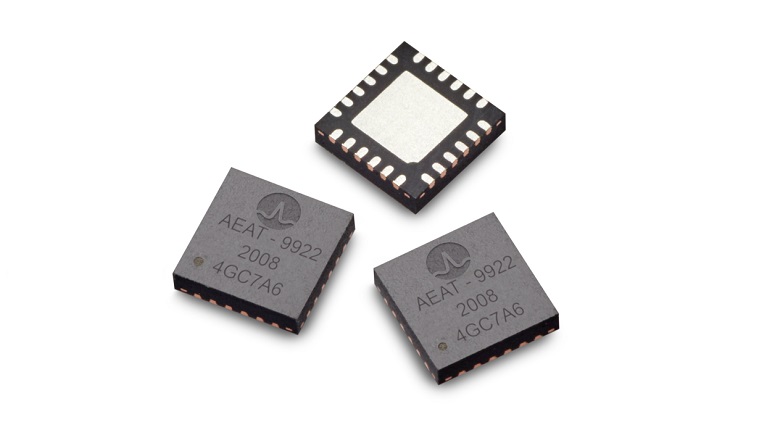

Broadcom is in the business of developing, designing and constructing the brain of your devices, or these little known things called chips.

No, not those kinds of chips, but the types of chips that power and allow your electronic devices to operate and perform essential functions in a matter of seconds, such as connecting to the nearest Wi-Fi station, for example.

But the buck doesn’t quite stop there, as Broadcom is also in the business of selling other various software products, primarily to enterprise or large business/organizational clients, including (but not limited to) products and capabilities within the data management space(s), the cybersecurity arena and a handful of others, serving a wide array of customers but also seemingly perpetually facing a stiff competition headwind given just how crowded the space has become in the last handful of years alone.

Let’s start with the clients.

Broadcom reportedly is a supplier and business partner for the likes of Apple, which just might be its largest and most influential client, along with Cisco Systems, Samsung, Dell Technologies, Hewlett Packard, Amazon Web Services (AWS), Verizon, Lenovo, and many others, providing the aforementioned products and solutions in a variety of contexts within their respective businesses.

Onto the company’s competition, Broadcom goes up against some formidable foes, such as fellow chip designers and manufacturers Intel, Qualcomm, Texas Instruments, Nvidia, Marvell, Micron and more, however, Broadcom and its management team over the years have been able to carve out a sizable, competitive moat, therefore, in very broad terms, this is not a company that anyone should even think about counting out.

Of course, merely not counting one out is markedly different than suggesting that a company’s stock (NASDAQ: AVGO) is worth buying and holding forever and ever, but this company is certainly one that is very, very important, especially with respect to where the technology sector and the world overall is headed, and regarding the company’s valuation and the other prevailing finances within this company, well, we are going to take care of that for you right about now.

Broadcom’s stock financials

First and foremost, if prior to this stock analysis article you were intent on purchasing your incredibly small stake of the Broadcom enterprise, it would serve you well to have a decent amount of disposable income or readily available investable capital, as a single share of this company’s stock will presently set you back around $1,250, with its share price skyrocketing in recent history (well north of 110% over the last one year’s span of time alone), leading us to also liberally speculate that Broadcom’s stock price is a bit overvalued at the moment, again, especially considering all of the AI hype enveloping the technology sector.

It would be nice to retroactively invest in shares, wouldn’t it?

Nevertheless, there’s no time like the present and in addition to its rather substantial share price, Broadcom is a $583.06 billion company (according to its market capitalization) and maintains a price-to-earnings (P/E) ratio of 38.40 and the company also flaunts an annually distributed dividend of $21 per each share owned, which, in comparison to the others we have seen in the past is frankly gigantic, paying investors $5.25 each quarter, largely insinuating that Broadcom oozes cash through its sales and semiconductor and software-related operations.

In briefly touching on the company’s current valuation and its prevailing share price, Broadcom is evidently one of those companies that was and continues to be swept up in the AI hype train, and while we do unequivocally believe that the promise and prowess of artificial intelligence is oh so real, we still value investing in companies and their shares at reasonable, unpainstaking valuations, and we might see through the company’s revenue figures that it is worth paying a premium for, but we frankly have our doubts, as there is a bubble forming and continuously growing within the generative AI sector, that just so happens to be very dot-com bubble-esque.

Buying at the top and selling at the bottom is a stark recipe for disaster, and we like to sleep well at night.

But maybe such a valuation is justified.

We shall see.

As it relates to the condition of the company’s balance sheet, Broadcom’s executive team is at the helm of just about $72.8 billion in terms of total assets as well as approximately $48.8 billion in terms of total liabilities, which is simply a great financial platform through which this company can continue operating off of, as it has a good deal of cash at its disposal, with which it can use to buyback stock, raise its dividend (as if it needs anymore raising!), pursue value accretive acquisitions or continue investing back into its current operations.

This overall balance sheet breakdown gives Broadcom plenty of options and options tend to be good, plain and simple.

Moving right along to the state of the company’s income statement, Broadcom’s recent annualized revenue figures (measuring since 2019) have certainly been trending upwards and rightwards, starting off at a base of almost $22.6 billion (as reported in 2019), rising throughout each and every year leading up to its latest reported revenue figure of $35.8 billion, as reported in late 2023, which is evidently a great rate of revenue growth, however, on this basis alone, we still hold the opinion that this company’s stock price (NASDAQ: AVGO) is still a bit too full of itself, and we will need to see some more concrete and compelling figures to justify paying this much of a demanding premium for an ownership stake in the company.

Ultimately, yes, we do believe it is worth paying a valuation premium for this company’s stock, generally speaking, however, just not at this commanding of a valuation.

This still should not diminish Broadcom’s notable revenue growth by any means, as it is still a mighty impressive growth rate.

Skipping over to the company’s cash flow statement, Broadcom has been growing both its net income and total cash from operations figures in an impressively expeditious manner, with, for instance, the company’s net income rising from just above $2.7 billion (2019) to its latest reported figure of $14 billion (2023), not to mention its total cash from operations growth as well, starting off at just shy of $9.7 billion in 2019 and making its way up towards its most recently reported figure of $18 billion, as reported in 2023.

This largely justifies such a large dividend offering, as this company’s management team has had seemingly no issue with generating more and more cash from its business operations and products and services, which in its own right is absolutely impressive.

Broadcom’s stock fundamentals

Of course, retrieving more cash from operations becomes a bit less challenging as one’s trailing twelve month (TTM) net profit margin rises and is higher than the industry’s aggregate average, and Broadcom just so happens to fit this description like a glove, as according to TD Ameritrade’s platform, the company’s TTM net profit margin is listed as 39.31% to the industry’s respective average of 29.16%, and being around 10% higher is a great competitive advantage, especially in a space that is as competitive as the semiconductor industry, out-profiting a good deal of its peers, once again leaving me some more assurance that its dividend is not only safe and secure, but likely to grow in the years to come, not to mention that such a TTM net profit margin allows this company to comfortably and continuously reinvest in its core platforms and offerings while also keeping the ultra-successful arms of the business, well, sustainably business as usual.

Lastly, in briefly delving into the company’s comparable TTM returns on both the assets and investment(s) spectrums, as also found through TD Ameritrade’s platform, Broadcom trails the industry’s averages in both of these categories, however, not by all that much, and considering that it apparently accounts for 4.8% of the entire global semiconductor market share (which may initially not seem like a lot, but please, it is a lot given how wide and deep the industry has been and is becoming), makes a good deal of sense since it just has that much more in terms of outstanding expenses and operations, as opposed to some of its smaller yet powerful competitors, that haven’t even secured a single percentage point of the semiconductor space.

Thus, we just don’t feel it is all that necessary to harp on this, especially with the sunshine-filled backdrop of its prevailing profit margins.

Should you buy Broadcom stock?

Let’s make it clear.

If nothing else was all that attractive regarding Broadcom and its most recent and current performance, the current valuation would’ve been the straw that broke the camel’s back, however, given the combination of its growing annualized revenues, its more than competitive TTM net profit margin, its sturdy, growth-oriented balance sheet for all seasons, its bolstering cash flows and the prospects that lie ahead of this company in the artificial intelligence space as well as general computing categories and cybersecurity as well, call us crazy, but we maintain that this company’s stock (NASDAQ: AVGO) has much more runway ahead of itself.

Even though shares of the company’s stock are objectively overvalued, the growth story has remained more than intact and given the current technological landscape, we don’t presume this will be changing anytime soon, therefore, we still feel comfortable in offering Broadcom’s shares a “buy” rating.

DISCLAIMER: This analysis of the aforementioned stock security is in no way to be construed, understood, or seen as formal, professional, or any other form of investment advice. We are simply expressing our opinions regarding a publicly traded entity.

© 2024 MacroHint.com. All rights reserved.